Determining how much house you can afford is a crucial step in the home-buying process, especially when you have a specific annual income, such as $70,000. Various factors, including your debt-to-income ratio, down payment, and interest rates, play significant roles in this calculation. This article aims to help prospective homebuyers understand how to navigate these complexities and arrive at a figure that reflects their affordability.

How much house can I afford if I make $70,000 a year?

If you earn $70,000 a year, you can afford a home priced between $250,000 and $350,000, depending on your other financial commitments and lifestyle choices. This range assumes a conventional 30-year mortgage at a 3.5% to 4% interest rate, a minimal debt-to-income ratio, and a down payment of at least 20%.

The Calculation Breakdown

To understand how we arrive at that affordability range, let’s break down the components involved:

- Monthly Income: Your gross monthly income is approximately $5,833 ($70,000 divided by 12).

- Debt-to-Income Ratio (DTI): Lenders typically prefer a maximum DTI ratio of 43%. This means that your total monthly debts—including the mortgage, property taxes, insurance, and existing debt payments—should not exceed 43% of your monthly income.

- Mortgage Payment: A general guideline is to aim for a mortgage payment that represents about 28% to 30% of your gross monthly income. For someone making $70,000, this translates to approximately $1,650 per month for housing costs.

Below is a table summarizing the monthly expenses based on various home prices:

| Home Price | Down Payment (20%) | Loan Amount | Estimated Monthly Mortgage Payment (4%) | Total Monthly Debt Limit (43% DTI) |

|---|---|---|---|---|

| $250,000 | $50,000 | $200,000 | $954 | $2,508 |

| $300,000 | $60,000 | $240,000 | $1,145 | $2,508 |

| $350,000 | $70,000 | $280,000 | $1,336 | $2,508 |

Factors Influencing Home Affordability

1. Debt-to-Income Ratio

Your DTI ratio is crucial in determining how much you can borrow. Lenders use this percentage to gauge your ability to manage monthly payments.

- 28/36 rule: A common guideline is that no more than 28% of your gross income should go to housing costs, while 36% should cover all debt obligations.

2. Down Payment

The amount you choose to put down on a home significantly affects your loan amount. A larger down payment lowers your monthly mortgage payment and can eliminate the need for private mortgage insurance (PMI), further decreasing your overall costs.

- For example, if you put down 20% on a $300,000 home, you would pay $60,000 upfront, leaving a loan amount of $240,000.

3. Interest Rates

Mortgage rates fluctuate, impacting your monthly payment. As of October 2023, interest rates average around 4% for a 30-year fixed mortgage. This can vary based on your credit score and the lender.

4. Property Taxes and Homeowner’s Insurance

Taxes and insurance can add significantly to your monthly payments. For example, homeowners in the U.S. pay around 1.1% of the home price in property taxes annually. Insurance typically varies, but budgeting around $100 to $200 a month is common.

Sample Monthly Budget

To help visualize how your monthly payments break down, consider the following budget for buying a $300,000 home:

| Expense Type | Estimated Monthly Cost |

|---|---|

| Mortgage Payment | $1,145 |

| Property Taxes (1.1%) | $275 |

| Homeowner’s Insurance | $150 |

| PMI (if applicable) | $100 |

| Total Monthly Housing Cost | $1,670 |

Important Considerations

1. Emergency Fund

Before purchasing a home, ensure you have a financial cushion for unforeseen expenses. Experts recommend having three to six months’ worth of living expenses saved.

2. Credit Score

A higher credit score can help secure a lower interest rate, making homeownership more affordable. Aim for a score of 740 or higher to get the best rates.

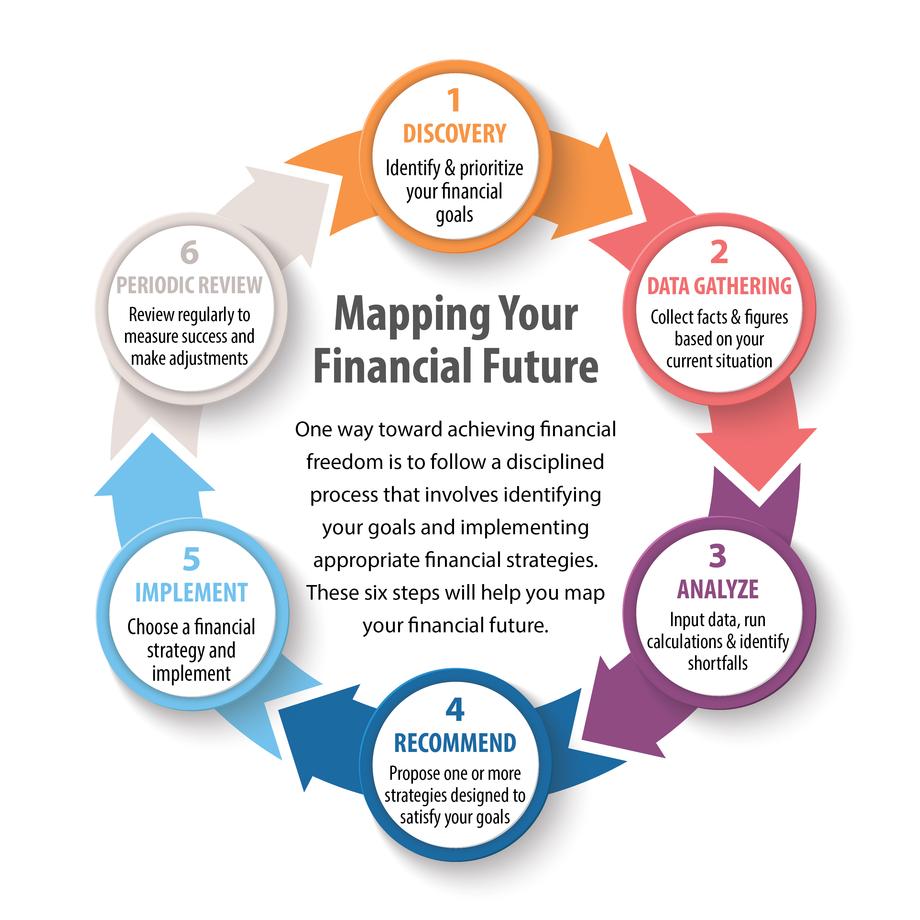

Visual Breakdown of Home Affordability

3. Location Variability

Home prices vary widely based on location. In some areas, a $350,000 home may be luxurious, while in others, it may only buy a modest home. Research local markets to understand what your budget can buy in your desired area.

Conclusion

If you earn $70,000 a year, buying a home priced between $250,000 and $350,000 is possible, depending on your financial situation. Assessing your DTI ratio, choosing an appropriate down payment, and factoring in interest rates will help you tailor your home purchase strategy effectively.

Understanding the nuances of home affordability allows prospective buyers to navigate the housing market more confidently. Proper planning, research, and consultation with financial advisors or mortgage lenders will ensure that you make informed and beneficial decisions throughout the home-buying process.