Federal funding, often thought of as a safety net for individuals and families experiencing financial difficulties, comprises various types of monetary assistance. This assistance can be particularly significant for students pursuing higher education, families facing hardships, and individuals needing support during challenging times. Understanding what qualifies as “free money” and how financial need impacts eligibility is crucial for those seeking assistance.

What type of federal funding is free money, but is based on financial need only?

The primary type of federal funding that qualifies as free money based on financial need is the Pell Grant, along with some additional federal grants such as the Federal Supplemental Educational Opportunity Grant (FSEOG). Both programs are designed to provide financial support to low-income students who demonstrate a significant financial need, ensuring access to higher education without the burden of repayment.

Overview of Federal Grants

Federal grants are monetary awards from government agencies to support various sectors, including education, health, and emergency assistance. Unlike loans, grants do not require repayment, making them a vital resource for individuals and families in need.

Types of Federal Grants

- Pell Grant: This is the most common federal grant awarded to undergraduate students based on financial need. As of the 2022-2023 academic year, the maximum amount a student can receive is $6,895.

- Federal Supplemental Educational Opportunity Grant (FSEOG): This grant is for undergraduate students with exceptional financial need. The FSEOG awards range from $100 to $4,000 annually, depending on the availability of funds at the participating institution.

- TEACH Grant: This program provides funding for students who are pursuing a teaching career in high-need fields. To qualify, recipients must commit to teaching for at least four years in a low-income school.

- Iraq and Afghanistan Service Grant: This grant is available for children of military service members who died in service to the country, with no need determination required.

How Eligibility is Determined

Eligibility for these federal grants relies heavily on financial need, which is assessed through the Free Application for Federal Student Aid (FAFSA). The FAFSA evaluates a student’s or family’s financial circumstances to determine the Expected Family Contribution (EFC). This figure represents the amount the family can contribute toward educational expenses. The lower the EFC, the higher the potential grant amount.

The U.S. Department of Education uses the EFC to decide eligibility for federal financial aid, which includes grants, loans, and work-study programs. Below is a breakdown of how the EFC affects grant distribution.

| EFC Range | Pell Grant Eligibility | FSEOG Eligibility |

|---|---|---|

| $0 – $5,000 | Maximum grant amount available | Higher chance of receiving grant |

| $5,001 – $10,000 | Decreasing grant amount | Possible eligibility depending on funds |

| Above $10,000 | Not eligible for Pell Grant; may qualify for FSEOG depending on financial circumstances | Limited or no eligibility |

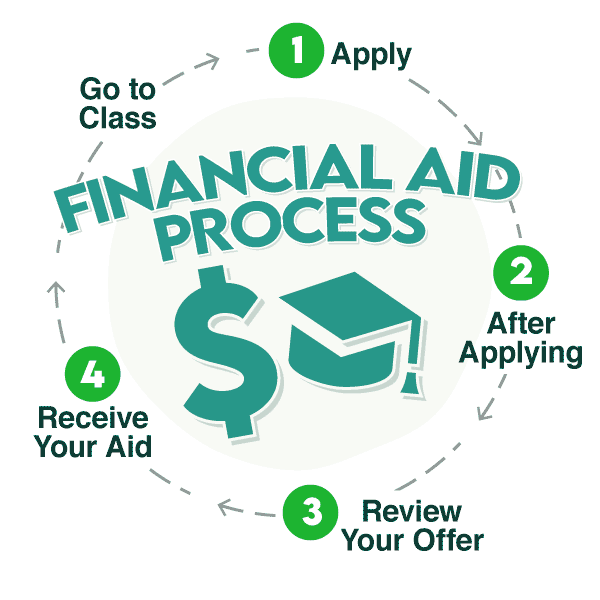

Application Process for Federal Grants

To apply for federal funding, applicants must complete the FAFSA by the designated deadlines. The application is available online and requires information about income, assets, and family size. It is vital for students to ensure that they provide accurate information, as any discrepancies can delay processing or affect eligibility.

Key Steps to Complete the FAFSA

- Gather Necessary Documentation: This includes Social Security numbers, tax returns, and records of untaxed income.

- Create an FSA ID: The Federal Student Aid ID allows individuals to sign the FAFSA electronically.

- Complete the FAFSA: Fill out the online form at the FAFSA website, providing required financial details.

- Submit the FAFSA: Review the application for accuracy before submission.

- Receive the Student Aid Report: This report summarizes the FAFSA information and the EFC.

Additional Resources for Financial Aid

Many colleges and universities also offer institutional grants and scholarships that can supplement federal aid. Students should explore all available funding options, including state grants and private scholarships, to maximize their financial support.

Tips for Finding Financial Aid

- Research Institutional Aid: Many colleges provide grants based on financial need or merit.

- Look into State Programs: States often have their own grant programs, which may have different eligibility requirements.

- Utilize Scholarship Search Engines: Websites like Fastweb or College Board can help find relevant scholarships based on specific criteria.

- Contact Financial Aid Offices: Speaking directly with college financial aid advisors can clarify options and eligibility.

Recent Trends in Federal Funding

Federal funding for education and social services has experienced fluctuations, especially in the aftermath of the COVID-19 pandemic. According to the National Center for Education Statistics (NCES), federal grants for higher education saw a nearly 2% increase in funding in 2021 compared to 2020, reflecting the government’s commitment to supporting students facing financial challenges.

Federal Grant Distribution Data

The following table illustrates the trend in federal grant distribution over the past three years:

| Year | Pell Grant Funding ($ Millions) | FSEOG Funding ($ Millions) | TEACH Grant Funding ($ Millions) |

|---|---|---|---|

| 2020 | 30,200 | 740 | 30 |

| 2021 | 31,000 | 750 | 33 |

| 2022 | 32,000 | 800 | 35 |

The data demonstrates a steady increase in funding, which highlights the government’s focus on making higher education more affordable for low-income students.

Final Thoughts

Federal grants provide essential support for individuals and families who demonstrate financial need. Programs like the Pell Grant and FSEOG are crucial for making education more accessible. Understanding the application process and exploring various funding opportunities can greatly enhance one’s ability to secure financial aid. By staying informed and proactive in seeking assistance, individuals can navigate the complexities of financial support and achieve their educational goals.